Strategies to Avert Excessive Debt Accumulation

Financial Compass North Rhine-Westphalia (FNRW): Navigating Financial Chaos

Check this out, mate!

- 20250602_ActionWeek_DebtorCounseling.pdfPDF - 245 kB

** topics:** Preventing financial calamity, Education on money matters

FNRW sounds the alarm on insufficient financial education

The FNRW shines a light on the hidden pitfalls of financial education in the Action Week Debtor Counseling, held from June 2 to 6.

- The Working Group on Debtor Counseling (AG SBV), composed of social debtor counseling centers and Consumer Advice Centers like FNRW, calls for urgent action under the motto "Best Investment - Financial Education. When Minus Becomes Plus".

Young adults burning cash without a clue

FNRW's overindebtedness expert, Christoph Zerhusen, points out that young people entering the adult world often lack the necessary financial skills to handle complex decisions. That's why it's crucial to start teaching financial awareness in kindergarten.

"Give us the basics early on, and we'll build a strong financial future," says Zerhusen. He emphasizes the essential role of teachers who are well-versed in financial education to guide generations to come.

Life's twists and turns require smart money moves

Whether you're changing careers, starting a family, or facing unexpected setbacks like illness or unemployment, financial knowledge is key to weathering life's storms. And that's where targeted support comes into play. FNRW stresses that prevention measures should cater to individuals' unique needs and situations.

Long-term vision for financial literacy

The AG SBV demands that the government commit to providing stable, long-term funding for financial education. They argue that temporary projects simply aren't enough to address the issue effectively. The AG SBV also advocates for a legal right to debtor counseling to help those who need it most.

FNRW serves 13 cities in Germany, offering free debtor and consumer insolvency counseling. They also support teachers in fostering financial education in schools.

For more information:

- Debtor and consumer insolvency counseling: https://www.financialcompass.nrw/counseling

- Financial education: https://www.financialcompass.nrw/learning

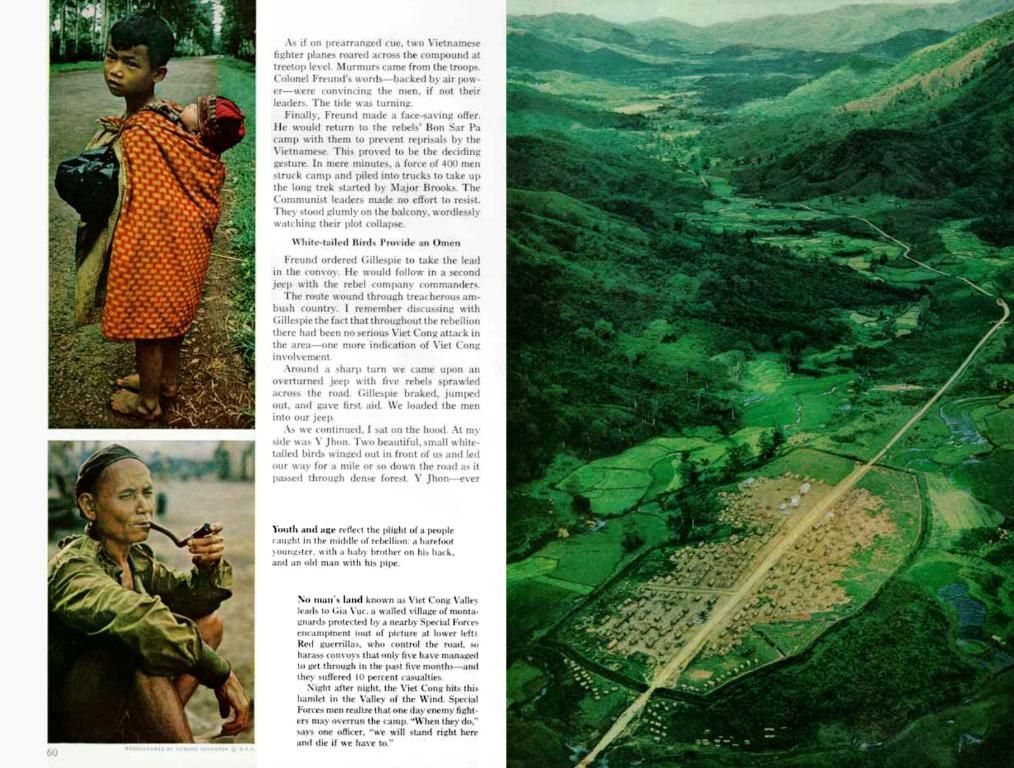

Pictures from FNRW's archives can be used freely as long as the original source is acknowledged. Please check the copyright notice on each image.

*Additional Insights:

- Lifelong Financial Education: Financial education should continue across the lifespan, not just during early years, to address the evolving financial needs of individuals as they age and move through different life stages.

- Digital Savings Accounts: To promote savings habits, the German government plans to implement digital savings accounts for individuals aged 6 and up. Each child will receive €10 per month from the state, and at age 18, they can add their own contributions to build a security cushion for their future.

- Preservation of Cash: As society becomes more digital, it's essential to maintain the role of cash in financial education to help children and young adults develop practical, hands-on money management skills.

- Digital Infrastructure for Schools: Efforts are underway to modernize schools' digital infrastructure through the Digital Pact 2.0 to support financial education initiatives and ensure access to up-to-date educational resources.

- Investments in Education: Education unions are pushing for increased funding to cover the backlog of investments in the education sector, which includes calling for a significant fund to support education projects from pre-school to university level.

- Embracing a long-term vision for financial literacy, Financial Compass North Rhine-Westphalia (FNRW) advocates for stable, long-term funding for financial education, acknowledging that temporary projects are insufficient to address the issue effectively.

- Recognizing the importance of efficient money management, FNRW emphasizes the need for targeted support that caters to individuals' unique needs and situations throughout their personal-finance journey, encompassing life's twists and turns, such as career changes, family start, or unexpected setbacks like illness or unemployment.

- To instill financial awareness from a young age, FNRW insists on the significance of teaching financial skills in kindergarten, ensuring a strong foundation for personal-finance management, personal-growth, and learning in the context of education-and-self-development.